How to Crack the Fibonacci Code in 3 Simple Steps:

Talking Points

- Use Fibonacci tool by connecting the last swing low and last swing high to show five doable areas of support

- search for value to show at one in all these five main levels before coming into a trade for the simplest doable risk to reward

- Place a protecting stop below next Fibonacci level and a limit at the zero.618 or 1.000 extensions

Have you ever seen a powerful trending move within the market and needed to be a part of it however failed to have the boldness to enter the trade?

Have you ever seen value simply stop at a particular a part of the chart so flip around?

If you answered “Yes” to either one in all these queries, then Fibonacci levels is also right for you.

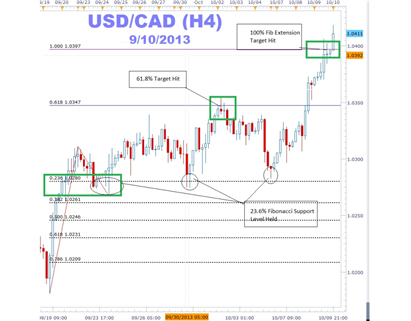

Learn Forex: USD/CAD Fibonacci Retracement:

- Use Fibonacci tool by connecting the last swing low and last swing high to show five doable areas of support

- search for value to show at one in all these five main levels before coming into a trade for the simplest doable risk to reward

- Place a protecting stop below next Fibonacci level and a limit at the zero.618 or 1.000 extensions

Have you ever seen a powerful trending move within the market and needed to be a part of it however failed to have the boldness to enter the trade?

Have you ever seen value simply stop at a particular a part of the chart so flip around?

If you answered “Yes” to either one in all these queries, then Fibonacci levels is also right for you.

Learn Forex: USD/CAD Fibonacci Retracement:

3_Simple_Steps_for_Using_Fibonacci_to_Time_the_Forex_Market_body_Picture_2.png, learn the way to Crack the Fibonacci Code in three easy Steps

(Chart Created mistreatment Market scope a pair of.0 charts)

Very merely, Fibonacci area unit mathematical ratios that value pulls back to before resuming the trend. The four major Fibonacci replacement levels are: 0.236, 0.500, 0.618, and 0.786. when value pulls back and bounces from one in all these levels, value sometimes moves up to at least one of 4 major Fibonacci extension levels; 0.618, 1.000, 1.27, and 1.618. to stay things easy, I'll not come in however these area unit mathematically derived.

In the higher than example, notice however USD/CAD created a powerful move up so began to tug back. By mistreatment the Fibonacci tools to attach the swing low with the swing high, hidden levels of potential support and potential value targets were discovered.

USD/CAD bounced sharply from 1.0280 at the 0.236 Fibonacci level. this can be wherever Fibonacci traders would enter into the market long with a stop just under the 0.382% Fibonacci damage. USDCAD went on to hit the primary target was hit at 1.0350 that coincided with the 0.618 extension so hit the 1.00 target of 1.0397.

Learn Forex: EURAUD Short Entry mistreatment Fibonacci

3_Simple_Steps_for_Using_Fibonacci_to_Time_the_Forex_Market_body_Picture_1.png, learn the way to Crack the Fibonacci Code in three easy Steps

(Chart Created mistreatment Market scope a pair of.0 charts)

Using a similar technique, Fibonacci levels will establish, prior to time, potential levels of resistance. These levels are often wont to enter a interchange a downtrend with additional confidence that value has turned from a part watched by many traders. within the example higher than, EUR/AUD is clearly in a very downtrend.

But like all downtrends, value retraces upward. instead of chasing the market, the savvy Fibonacci traders will have these levels of potential resistance drawn days ahead on their charts and wait with patience for value to come back to them.

Patience is rewarded because the EUR/AUD advance was stopped at the 0.618 Fibonacci resistance level. Forex Fibonacci traders would place a stop simply higher than the 0.786 Fibonacci level with a target at the 0.618 extension.

By following these easy steps, traders will currently notice high chance reversal areas mistreatment Fibonacci replacements to enter into trends confidently.

0 comments:

Post a Comment